Think a friend or colleague should be getting this newsletter? Share this link with them to sign up.

Good afternoon! Novo Nordisk and Eli Lilly have so far dominated the booming market for a class of weight loss and diabetes drugs.Â

But Eli Lilly may be starting to gain an edge over its Danish competitor in the two-horse race to capitalize on the soaring demand for those treatments, also known as GLP-1s.Â

That became clear last week after the pair reported their respective second-quarter earnings.Â

“Lilly is pulling ahead in the metabolic duopoly,” BMO Capital Markets analyst Evan Seigerman said in a research note Thursday.Â

On Aug. 7, Novo Nordisk trimmed its full-year profit outlook after reporting that quarterly sales of its weight loss injection Wegovy came in well below Wall Street’s expectations. The disappointing result came due to higher-than-expected price concessions to pharmacy benefit managers, which negotiate drug discounts with manufacturers on behalf of insurers, executives said on a conference call last week.Â

Revenue from its blockbuster diabetes drug Ozempic also failed to meet estimates for the period. The company’s stock plunged.Â

Still, Novo Nordisk slightly increased its guidance for full-year sales growth.Â

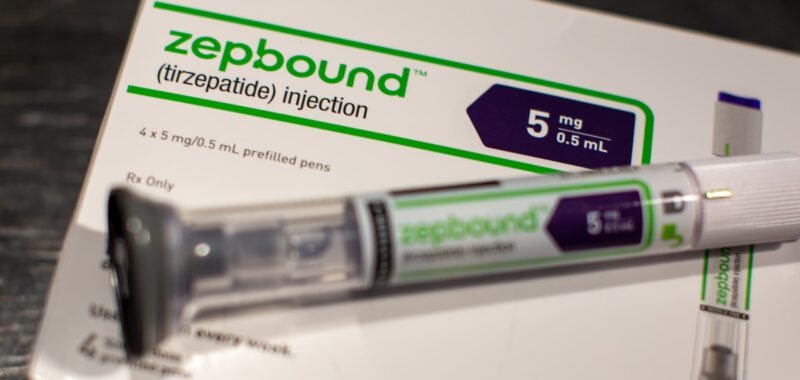

Eli Lilly’s quarterly report one day later was an entirely different story. The Indianapolis-based company’s weight loss injection Zepbound and diabetes treatment Mounjaro smashed expectations for the second quarter.

Eli Lilly hiked its 2024 revenue outlook by $3 billion and raised its full-year profit guidance on the strong performance of Zepbound and Mounjaro and “improved clarity” into the company’s production expansions for those drugs.Â

Unlike Novo Nordisk, Eli Lilly benefited from higher U.S. prices of Mounjaro in the quarter as use of savings card programs for the drug decreased. Executives said they expect “stable pricing” for Mounjaro and Zepbound across the last two quarters of 2024.Â

Eli Lilly shares closed more than 9% higher on Thursday.Â

Several analysts were particularly pleased with Eli Lilly’s positive manufacturing updates. Demand for weight loss and diabetes drugs is outstripping supply in the U.S., so companies that can quickly get more of a product to patients can gain an edge in the space.

All doses of Mounjaro and Zepbound are now listed as available on the Food and Drug Administration’s drug shortage database. Meanwhile, some doses of Wegovy are in limited supply as Novo Nordisk pours billions into its own manufacturing expansion efforts.Â

In a research note Thursday, Bank of America analysts raised their combined revenue forecast for Mounjaro and Zepbound to $19.7 billion in 2024, $31 billion in 2025 and $38.5 billion in 2026 because they have “gotten more comfortable with supply dynamics.”Â

The analysts said there could still be intermittent supply shortages of Mounjaro and Zepbound in the near term “as access improves and physicians get more comfortable with the availability of supply.” But they applauded Eli Lilly’s progress towards beefing up its manufacturing footprint and supply.Â

For example, Eli Lilly CEO David Ricks said on an earnings call Thursday the company has built six manufacturing plants, some of which are already ramping up, and hired thousands of workers to increase production. The company acquired another site earlier this year.

Eli Lilly expects incretin drug production â another term for weight loss and diabetes treatments â in the second half of 2024 to be 50% higher than it was during the same period last year, he added. Â

Ricks said Eli Lilly’s ability to scale up manufacturing of Zepbound and Mounjaro makes the company confident it can compete with newcomers to the weight loss and diabetes drug market that may not have the same capacity.

“I don’t know if it’s a barrier, but it certainly is work to do: Scaling manufacturing,” Ricks said.Â

“You’re talking about making things on the billion scale, which takes time and is technically difficult and very capital-intensive,” he continued. “So, of course, competitors will have to come. But there’s a large road ahead for all these [other drugmakers] that the two leading companies have already walked in large part.”

Feel free to send any tips, suggestions, story ideas and data to Annika at annikakim.constantino@nbcuni.com.

Latest in health-care technology

Stryker to acquire artificial intelligence startup Care.ai

Medical technology company Stryker on Monday announced it has agreed to acquire Care.ai, in yet another artificial intelligence-related deal within the health-care sector.Â

Care.ai uses tools like AI-powered sensors to help clinicians monitor patients and workflows across hospitals, skilled nursing facilities and assisted living facilities. The company raised $27 million from Crescent Cove Advisors in 2022.

Stryker offers medical and surgical equipment and a range of products in orthopedics and neurotechnology. The company said technology like Care.ai’s is of “increasing importance” as health-care organizations contend with challenges like nursing shortages, burnout, administrative burden and workplace safety concerns, according to a release Monday.Â

The terms of the deal were not disclosed, and Stryker said the acquisition is subject to customary closing conditions.Â

Shares of Stryker were mostly flat on Tuesday.Â

“Care.ai will help Stryker significantly accelerate our healthcare IT and digital vision to provide customers with real-time, smart and connected decision-making tools that enhance the lives of caregivers and their patients,” Andy Pierce, group president of MedSurg and Neurotechnology at Stryker, said in the release.

The technology Care.ai offers will “integrate seamlessly” with Stryker’s platforms and devices, the company added.Â

“Our commitment to simplifying and enhancing the lives of healthcare professionals and patients remains unwavering,” Chakri Toleti, founder and CEO of Care.ai said in a post on LinkedIn Monday. “Together, we are transforming healthcare, ensuring that we always prioritize the well-being of those who need care and those who dedicate themselves to caring for others.”

Stryker declined to comment. Care.ai did not immediately respond to CNBC’s request for comment.Â

Read the full announcement here.

Feel free to send any tips, suggestions, story ideas and data to Ashley at ashley.capoot@nbcuni.com.