Gaming merger and acquisition (M&A) deal activity increased for the 4th straight quarter during the September period with $2.5B in disclosed deal value and over $1 billions raised in private financings.

Drake Star Partners reported in its quarterly gaming report that the market got a boost in part as public markets continued to recover, with the Drake Star Gaming Index of public game companies growing 10.2% for the first nine months of the year.

It also helped that the initial public offering (IPO) of Tencent-backed Shift Up surged almost 50% on its trading debut. It’s not exactly something to celebrate, as there are still some very tough times for the losers in the gaming industry now, with more than 32,000 layoffs in the past three years. Konvoy Ventures, which keeps its own separate quarterly data, sounded a similar note of greater optimism.

“We are thrilled to announce that M&A activities have continued to gain momentum for the fourth consecutive quarter. It’s also encouraging to see a rebound in the valuations of the top 30 listed gaming companies,” said Michael Metzger, partner at Drake Star Partners, in an email to GamesBeat. “This ongoing recovery in valuations is likely to further stimulate M&A activity in the future.”

Metzger added, “So far this year, private equity firms have been the top buyers, and we expect to see more significant PE deals alongside smaller tuck-in acquisitions from companies like Jagex/CVC and Keywords/EQT. Additionally, we foresee several major divestitures of gaming divisions in the upcoming months.”

M&A activity

Still, it’s a ray of hope in at a time when investors crave good news. With 56 announced M&A deals and $2.5B in disclosed deal value, Q3 continued the strong uptick in M&A activity for the 4th straight quarter (70% growth in number of deals compared to Q3 last year).

Playtika’s acquisition of SuperPlay for $700 million at close ($1.95 billion including the full earn-out over time) was the largest deal of the quarter. Other notable acquirers included Tencent (Aojue Digital), Warner Bros. Discovery (Player First), Krafton (Tango Gameworks), Capcom (Minimum Studios), Keywords (Wushu Studios), Nazara (Fusebox, Deltias Gaming) and Infinite Reality (LandVault).

Private financings

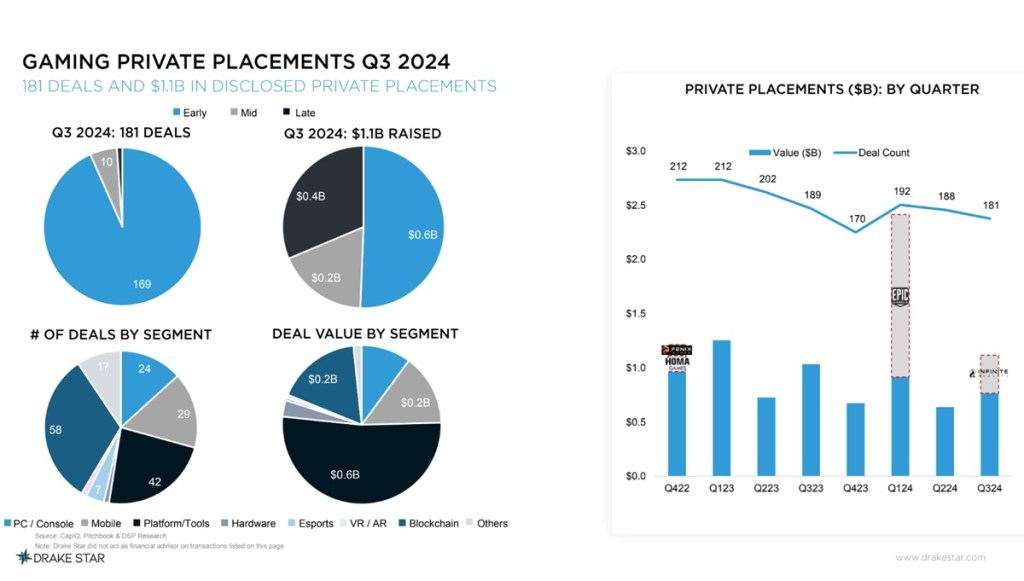

Drake Star said $1.1 billion was raised in private financing through 181 deals, a notable growth in deal value, but the number of deals was similar relative to Q2. Large private financings included Infinite Reality ($350 million), Hybe ($80 million), Gcore ($60 million), Volley ($55 million) and Saber Interactive.

Drake Star said investors continue to invest primarily in seed / early-stage companies (over 90%). Blockchain gaming attracted about 32% of all investments and platform / tools about accounted for 23%. Funding for growth stage gaming studios continued to be challenging. In some previous quarters, blockchain games accounted for half of all fundings.

Andreessen Horowitz and Bitkraft were the most active large gaming VC over the last 12 months followed by Play Ventures. Early-stage gaming and consumer investor Patron has raised $100 million for its second fund.

Tencent backed Shift Up had a successful IPO with stock surging around 50% on trading debut (raised $320 million), while India’s Nazara raised over $100 million in equity. Embracer Group refinanced its credit line ($652 million) and Kakao Games raised $198 million in bonds that are exchangeable for Krafton shares owned by Kakao.

With a gradual recovery in public markets, Drake Star Gaming Index grew 10.2% for the first 9 months of this year. Top performers were SEA, Konami and Krafton and laggers were Ubisoft, Corsair and Unity.

Outlook

M&A activity is expected to further strengthen for the rest of this year and next, continuing its strong growth over the last year, on the back of lowering interest rates and a gradual broader recovery in the public gaming market.

While Drake Star expects some large transformative deals from industry leaders such as Tencent, Take-Two, Savvy/Scopely and Playtika, the trend of strong growth in mid- to small-sized deal count will likely continue. With limited mid- or late-stage funding available, some gaming studios will choose an earlier exit and join a larger company.

Private equity firms have been a major consolidator this year (CVC/Jagex, EQT/Keywords), and Drake Star expects more acquisitions and take-private deals led by financial sponsors. Drake Star also expects more divestitures of large gaming divisions.

For private financings, AI, mixed reality, platform and tools continue to be hot segments.

As broader gaming markets continue to recover, Drake Star anticipates IPO-ready gaming companies to start exploring their listing ambitions in 2025.

Source link