Across the U.S., family members caring for loved ones provide an estimated $600 billion in unpaid services each year, sacrificing time, money and often their well-being to care for aging loved ones, according to an AARP survey.

As Congress considers a bill that would provide family caregivers a tax credit, quantifying how much that time is worth is proving to be difficult.

Amy Goyer understands the challenge. Caring for her aging parents meant turning her life upside down. Her mother had a stroke in her late 60s and her father was diagnosed with Alzheimer’s disease.

Family caregivers face a financial toll

Pictures line the walls of Goyer’s home in Chandler, Arizona. They’re filled with memories of a lifetime that became a source of stress and financial strain. As a caregiver for her parents, she had to pay for renovations to safety-proof her home. She also lost money and time when she could have been working more to care for her parents.

CBS News

“It was financially devastating for me,” Goyer said. “I don’t have regrets about anything I did in caring for my family, but I ended up in bankruptcy after my dad passed away.”

Goyer, also a caregiving expert for AARP with more than 35 years of experience, was not immune to the financial strain of caring for her parents.

“How are you supposed to take care of yourself, your family and your home when you’re working two jobs — one paid and one unpaid for your loved ones?” she asked.

The burden Goyer faced is becoming more common across America. According to a Harvard Business School report, 73% of American workers surveyed provide some type of caregiving at home.

Calculating the cost

Shon Lowe has been caring for her mother, Terrie Montgomery, since her Alzheimer’s diagnosis a decade ago.

CBS News

The financial toll on families can be high. AARP calculated family caregivers spend an average $7,242 of their own money each year, according to a 2021 survey. That doesn’t include the time they spend taking care of things, such as managing medication, finances and food prep.

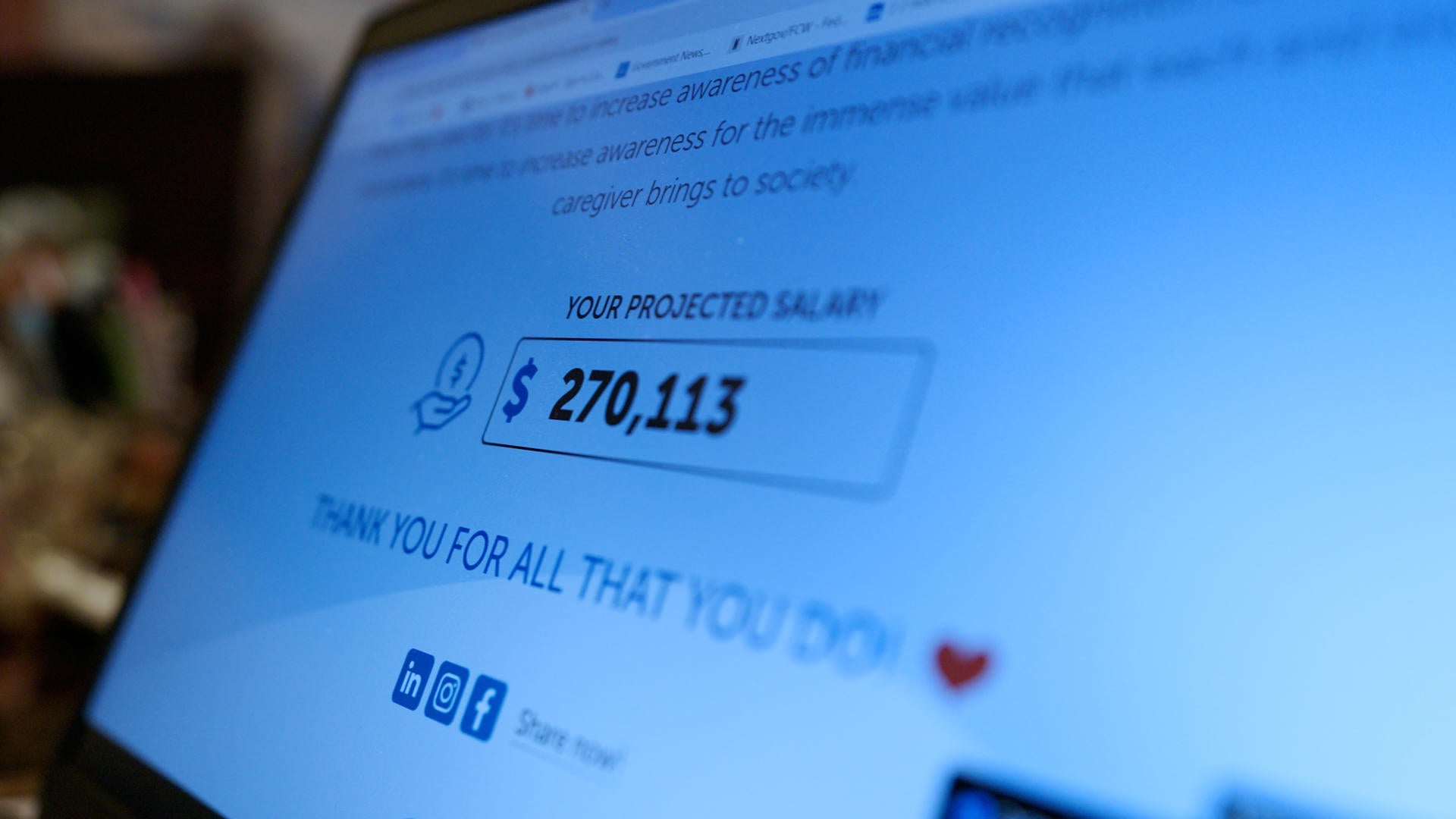

Salary.com and Otsuka Pharmaceuticals, maker of medications for neurological disorders like dementia, said they created a new tool, which offers a clearer picture of the financial cost of caregiving. The cost is often hidden but felt deeply by families everywhere.

Lowe tried the Family Caregiver Calculator, which calculates the financial value of caregiving based on geography, time spent, and the type of work done for family caregivers. When she entered the hours she and her siblings spend caring for their mother, the result was $270,103 per year.

“It’s unbelievable,” Lowe said. “Something should be done about that.”

CBS News

Financial help is available for families

The creators of the Family Caregiver Calculator hope to urge policymakers to pass legislation, which supports unpaid family caregivers and help families budget for caregiving expenses.

“We largely don’t have enough support,” said Amy Goyer.

She added that without more resources, the financial burden will only grow for future generations.

“We’re putting our caregivers’ financial security in jeopardy,” she said. “They’re not going to have the money to pay for someone to care for them.”

While some states have programs that allow family caregivers to receive compensation, Goyer explained these opportunities are limited.

A recent report to Congress by the Recognize, Assist, Include, Support and Engage (RAISE) Family Caregiving Council proposed several potential solutions to ease this burden, including a federal tax credit for family caregivers, immigration reform to expand the caregiver workforce, and expanding grant programs for states.

These solutions offer hope to families struggling under the burden of caregiving but require congressional action. If passed, the Credit for Caring Act, introduced in Congress this year, would provide a federal tax credit of up to $5,000 to qualifying caregivers.

AARP is advocating for the passage of this bill, stressing it would bring much-needed relief to caregivers who are often financially stretched while caring for their loved ones.

Without financial help, Goyer said families end up passing down debt from one generation to the next.

“What we’re doing is we’re putting the financial security of our caregivers in jeopardy in the future,” Goyer said. “So they’re not going to have the money to pay for somebody to take care of them.”

Laura Geller

contributed to this report.